ROLEX X BUCHERER A successful partnership

“Rolex has acquired a flagship retailer”

Marco Gabella, Editor-in-Chief of Watchonista

On August 25, Rolex created the surprise of the year. The legendary brand founded by Hans Wildorf in 1905 announced that it was acquiring the world’s largest watch retailer: Bucherer. A well-known address for all watch enthusiasts, the retailer is celebrating its 135th year in business this year! Founded in Lucerne in 1888 by Carl F. Bucherer, Bucherer is today one of the most powerful watchmaking dynasties. A look back at a long-standing friendship!

AN $11 BILLION FRIENDSHIP!

Bucherer and Rolex are two inescapable watchmaking empires. One established itself as a multi-brand retailer, the other is today the most powerful brand in the watch industry. Both No. 1 in their specialties, in just a few decades these two entities have carved out a prime position for themselves on the international market.

While Bucherer is the world’s leading retailer, with sales estimated at over CHF 1.7 billion, Rolex’s success is harder to measure. Much more enigmatic about its results, the watch industry’s most powerful brand systematically refuses to communicate its performance. The golden rule? No figures come out of Rolex, nor any indication of the number of watches produced.

However, according to the American bank Morgan Stanley, in 2022 Rolex will have achieved sales of CHF 9.3 billion. This compares with sales of CHF 2.7 billion for Cartier, in second place, and CHF 2.4 billion for Omega, in third place.

With a market share of almost 30%, Rolex is well ahead of all other brands, and even well ahead of Patek Philippe (CHF 1.8 billion).

ROLEX, N°1 WORLDWIDE

The year 2022 marks a decisive turning point in the history of Rolex. For the first time in its history, the brand is No. 1 in a highly promising market: China. Establishing itself as the preferred brand of the Chinese, Rolex dethrones Patek Phillippe, which had held first place since 2012!

This event reflects the growing appeal of the brand, whose popularity has literally exploded since 2020! Demand for Rolex watches has never been so high, and this craze is generating interminable waiting times. Unfortunately, there’s another side to the coin. Investors now see the brand’s iconic models as an investment, and some collections have become “safe assets”. Daytona, GMT-Master or Submariner, these references have seen their value triple or even quadruple between 2020 and 2022. The time it takes to get a Rolex in a boutique has never been so long. And yet, paradoxically, Rolex has never produced as many watches as it does today. Some experts even estimate that by the end of 2024, the brand will be able to deliver 2 million watches.

BUCHERER A GOLDEN PARTNER

Although Bucherer was founded by Carl F. Bucherer, the retailer should not be confused with the eponymous manufacturer. These are two very distinct entities, and the acquisition made by Rolex concerns only the multi-brand distribution activity.

20 years ago, Bucherer had barely 20 boutiques. Today, it has almost 100 points of sale worldwide, from Copenhagen to Las Vegas.

Yet until 2012, the retailer had just 33 stores, but 2013 was the starting point for an international expansion drive. To celebrate its 125th anniversary, the brand moved to Paris and opened the world’s largest luxury watch store. Located at 12 Boulevard des Capucines, in a Hôtel Particulier owned by the Richemont group, the sales space is spread over 3 floors. In 2017, Bucherer continued its expansion with the acquisition of 6 boutiques in London. In 2018, the brand expands into the United States with the acquisition of the Tourneau group, the leading retailer in the USA.

Bucherer is now the world’s number 1 watch retailer. Distributor of Rolex, but also of Tudor, the retailer also officiates as official service center for both brands.

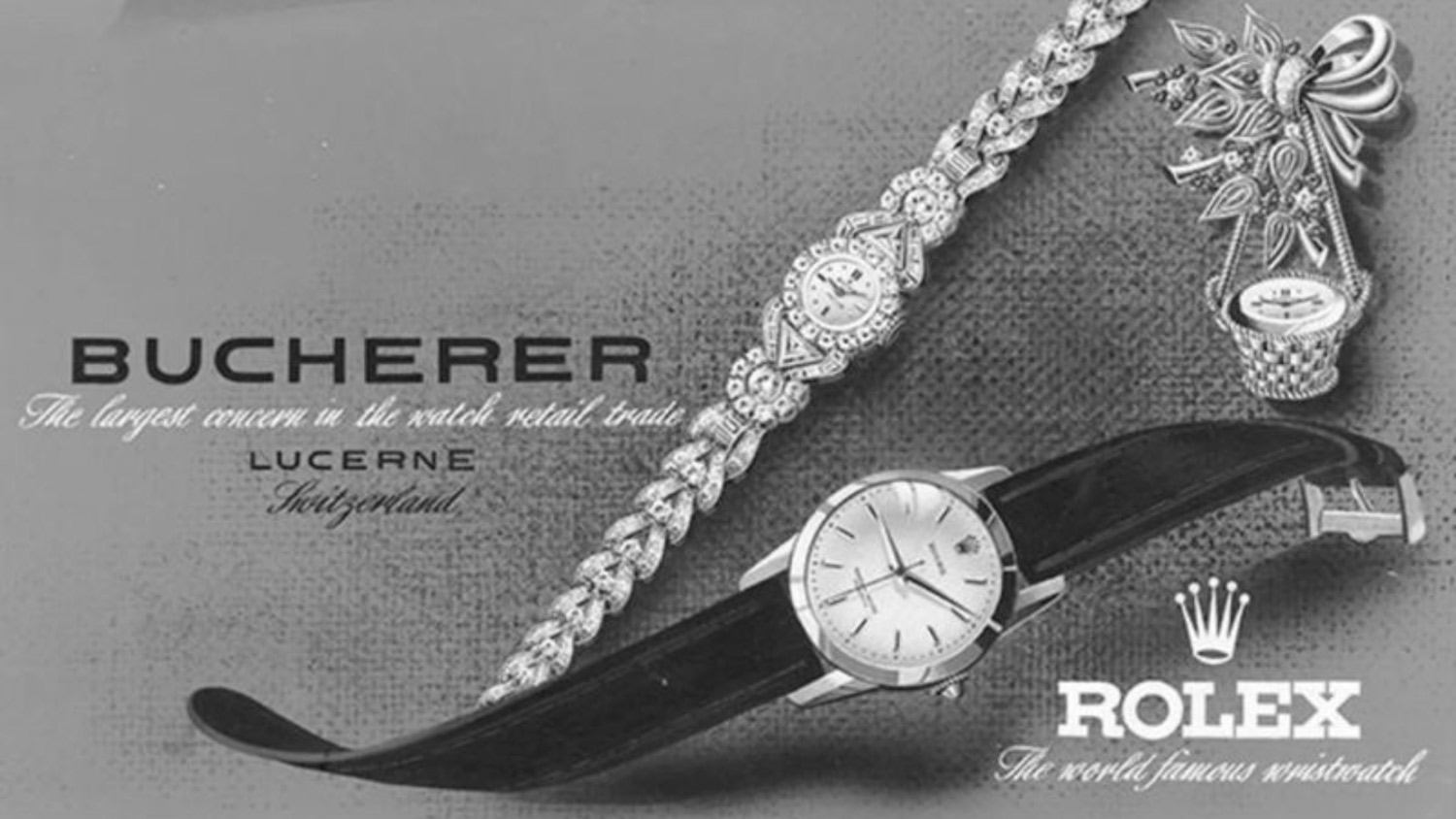

A LONG-STANDING FRIENDSHIP

During the Roaring Twenties, Bucherer established itself in Switzerland and Europe as one of the finest luxury addresses. Offering watches and jewelry signed by the greatest names in watchmaking and jewelry, this boutique based in Lucerne, Switzerland, attracted a wealthy and elitist clientele. This solid reputation attracted Hans Wildorf, who in the 1920s sought to raise the profile of his fledgling watch brand. In 1924, Ernst Bucherer, who had succeeded his father Carl F. Bucherer at the head of the company, signed a partnership agreement with Hans Wildorf. Bucherer thus became one of the first official Rolex dealers.

Like all major retailers, Bucherer affixed its name to the dial of the watches it sold. Today, the famous “Rolex / Bucherer” is one of the most sought-after double signatures among collectors, and regularly achieves excellent results at auction.

The 1920s models are already highly prized on the collector’s watch market. This year, a steel Prince Brancard model fetched 19,500 in Monaco (MonacoLegend, sale April 23, 2023, no. 2), almost double its estimate.

The popularity of this double signature has grown steadily over the past 15 years. Already in 2009, Christie’s recorded a result of $25,000 for a 1930s Bubble Back model in pink gold signed “Rolex / Bucherer”.

To date, Phillips has the best result for a double Rolex/Bucherer signature. A rare steel chronograph, ref. 2538, produced around 1937, which sold for CHF 48,260. (sale May 13 and 14, 2023, lot 68). For all connoisseurs, “Rolex/Bucherer” is a particularly exciting double signature, as it materializes this “long-standing friendship” between the two watchmaking giants.

At the end of the 1940s, Bucherer stopped affixing its signature to the dials of resold watches, and this mythical double signature disappeared. Instead, the retailer specialized in the distribution of particularly exclusive Rolex timepieces. An OysterQuartz Day-Date model, mounted on a rare “Pyramide” bracelet presented for sale a few years ago, is a perfect illustration of this trend (Phillips, sale November 28, 2017, lot 896).

A NEW STRATEGY?

What is Rolex’s ambition in buying Bucherer? This is clearly one of the most burning questions of the moment.

Is Rolex looking to take control of the retail market? That’s the ambition that some have guessed. The major risk would then be that Rolex would review its distribution and redirect its supply channels in favor of Bucherer. The risk for other Rolex ADs would then be that they would no longer be able to offer the usual Rolex / Tudor range, but a more limited one, which would then have a significant impact on point-of-sale sales.

Bucherer’s direct competitor, Watches of Switzerland, was directly affected by the August 25 announcement. Founded in London in 1924, this historic retailer generates around 55% of its profits from the sale of Rolex and Tudor watches. In the space of a few hours, Watches of Switzerland fell 22.5% on the London Stock Exchange, a sign that investors saw Rolex’s takeover of Bucherer as a threat to other star retailers.

But for some market experts, the analysis is different. Marco Gabella, editor of the online media Watchonista, confirms that no “earthquake” is to be expected. The most telling proof is Rolex’s unrivalled loyalty to its retailers. It’s worth noting that Rolex is one of the very few brands not to sell online via its website, since in-store sales are the only way to acquire a Rolex watch, a precious advantage for authorized retailers. It is therefore unlikely that Rolex will change the way it redistributes its watches.

On the other hand, this takeover would be motivated by Rolex’s desire to protect its privileged position in the market. Today, the brand with the crown alone holds almost 30% of the watch market. And Bucherer, Rolex’s main partner, is still a family business run by the 3rd generation. As yet, no heir has expressed interest in taking over the reins of this colossal empire. Clearly, the sale of Bucherer was on the cards for the next few years.

For Marco Gabella, this is precisely where the strategy comes into play: by buying Bucherer today, Rolex avoids the risk of “this entity passing into foreign or malevolent hands” later on. The purchase of Bucherer by Rolex was inevitable. This strategy is comparable to the one developed in 1931 by dial-maker Stern. When Patek Philippe, its biggest customer, was experiencing serious difficulties and on the verge of bankruptcy, the Stern family chose to buy out its most valuable customer, so as not to risk losing a vital market.

This parallel demonstrates that, in life as in watchmaking, unity is strength.