MB&F and FP Journe on the forefront of auctions in Hong Kong

This first auction of the season in Hong Kong under the new leadership of Sam Hines at Sotheby’s set the trend for collectors in Asia. Likewise, the sale was focused on the two star brands Patek Philippe and Rolex but it is very clear that independents are now more and more present in major auction capitals. In the top 8 brands we have FP Journe as one the market leaders on this niche market segment.

This time again we noticed some impressive results that might give some market insights for collectors in this area of watch collecting. In this report, we see that all independents do not perform on the same level and some brands are much sought after than others.

If there is a duopoly behind Patek Philippe and Rolex at watch auctions, the same could apply to the art market with Christie’s and Sotheby’s. If the two tycoons have the same playground in each capital, their strategy on the watch market segment are completely opposite.

Sotheby’s with a good number of watches presented in this last auction did not take the easiest approach to target high and best prices. Nonetheless they still achieved results well above their low estimate for some independents well curated.

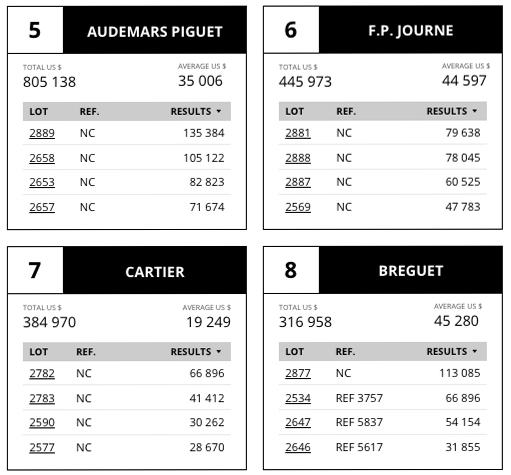

Brands :

Among all the brands present in this first session of the season in Hong Kong, FP Journe and MB&F are clearly the two independents that gave the strongest impressions in terms of results. In an environment where the primary market has been difficult over recent years, we see that the strategy from these two brands to control the secondary market is now paying off on the auction block, only if auctioneers are selective in the pieces to be offered in their catalogues. Selection is the key element that makes good prices on the secondary market and sometimes even better results than primary market which was the case in this auction for MB&F rare pieces. Taking out the fever on sports models like the Daytona for Rolex and the Nautilus for Patek Philippe, where prices are flying up to record levels for the steel versions from all periods, we have noticed that modern complicated timepieces for Patek Philippe are not as highly demanded as they used to be.

Statistics :

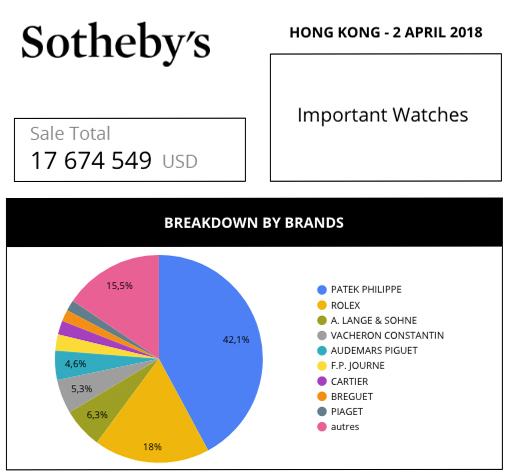

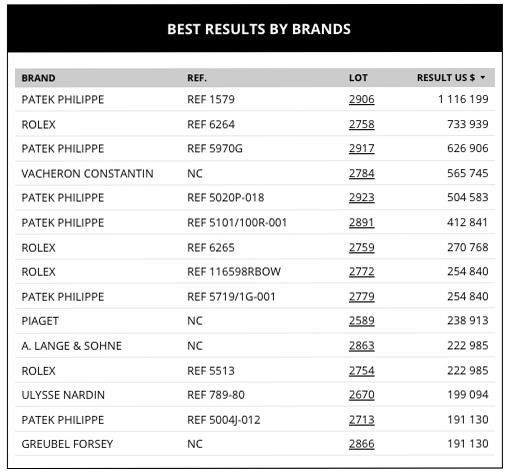

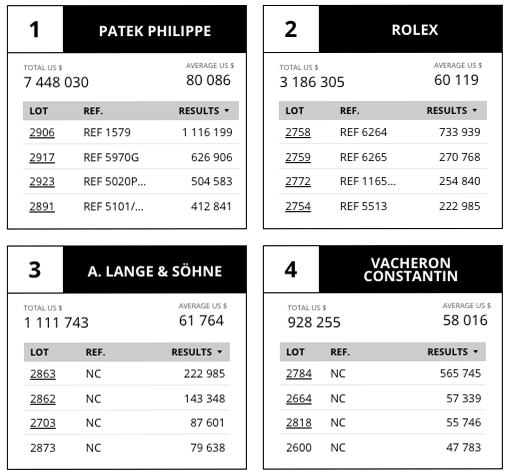

This first auction by Sam Hines at Sotheby’s clearly showed a market change from the auction house perspective where figures are significantly higher, mostly due to the two star brands Patek Philippe and Rolex which represented more than 60% of the sale total of 17,6 million USD. If these two brands are clearly defining the most significant part of all revenues from the auction world, it is also interesting to notice the presence of brands from the Richemont Group in the top ranking. Hence, A. Lange Söhne and Vacheron Constantin arrive in third and fourth position. If these brands cannot be considered as independents, their philosophy is clearly tied up to the same values as independents where craftsmanship is clearly an element of differentiation among all competitors.

Analysis :

Looking carefully in details on the large variety of offerings in this last auction, one can notice that some numbers speak for themselves for specific models where prices achieved where well above the original estimates. Again, results were impressive for sports watches like the Patek Philippe Nautilus Ref. 5711/1A, where the final hammer price was nearly double the retail price. If this is one of these exceptions on the secondary market for sports watches by either Patek Philippe or Rolex, one should also observe very carefully the results achieved by MB&F in the independents’ category where a Legacy Machine 1 Silberstein and the Destination and Moon Blue sold for double its estimate. This demonstrates the strong dynamic behind some independent watchmakers at auction. If pieces are well curated and largely documented like in the last Sotheby’s catalogue with the support and advice from the brand, it is producing the best effect to the collector’s community, which explains these impressive results.

Prices :

If prices achieved were strong in this first auction session of the season in Hong Kong, no world records in the category were beaten. However, we can notice that some pieces in this market segment performed extremely well like specific models from FP Journe. The two rare versions of Vagabondage II & III signed by FP Journe both doubled their original estimates which perfectly illustrates the new dynamics on the secondary or collector’s market. But it is by no coincidence that FP Journe brand might be tomorrow the price maker in the category. Its founder has understood the importance of taking care of the collector’s community to boost the prices on the secondary market. It was a year ago when Francois-Paul Journe announced that he would buy vintage models from his production to develop a Pre-Owned Certified section. This is the strategy that pays off with amongst collectors in the market segment of independents. MB&F follows the same trend with Max Busser who is heavily involved in the same market segment which explains good prices for his rarest timepieces as well.

Markets :

With one of the largest community of collectors for independents and others, Hong Kong is a major market for independents. While Dubai started off the season a month ago with some spectacular results in many areas of the watch market, Hong Kong clearly demonstrated that collectors are now more and more selective and picky about which independent watches to choose. MB&F and FP Journe have clearly shown the way to market leadership in this segment over this last session at Sotheby’s. Vision and anticipation from these two brands are clearly making the difference in the eyes of collectors.

Trends :

In these results, we observe that collectors are becoming more and more selective in their choices. This is again a difficult adequacy to meet for auctioneers where it is always the overall result that counts more than the way by which one can achieve the best result for each watch. This needs to change if we want to see strong results on the auction block for independents. Certified Pre-Owned is a new chapter opening soon in the watch industry, especially for MB&F and FP Journe, so the selection will only be the criteria by which to choose the best among all independent watchmakers.

Recommendations :

Less is more for the live auction world. How can one convince new comers to go through live auctions where there are too many lots? It is not profitable on the long run and the example given by Christie’s and Phillips – where they have diminished the number of lots in each live auction catalogue – is the only one valid in a more and more digital world. Soon Sotheby’s will catch up also with online auctions. Standard and less rare watches hopefully will go through the online channel and only the best selection will be presented through live auctions. This is truly the best that could happen for independent watchmakers with only a curated selection of all the best and rarest pieces.

GEOFFROY ADER